Bankruptcy and Tax Refund Season - When is the best time to file bankruptcy if you are expecting a large tax refund?

Adrian Lynn • December 21, 2025

Is there a better time to file Bankruptcy based solely on tax refunds?

Why January Can be a Strategic Time to File Bankruptcy

For many people who get large refunds, January creates a unique opportunity:

1. Last Year’s Refund Is Usually Already Gone

By January:

The prior year’s refund has often been spent on living expenses, catching up bills, or holiday costs.

It’s no longer sitting in the bank creating exemption issues.

That can mean:

✔️ lower cash balances

✔️ fewer assets to protect

✔️ a cleaner financial snapshot at filing

For many clients in Fort Myers, Cape Coral, and Lehigh Acres, Naples and Florida this alone makes January an ideal time to move forward.

2. The New Refund Hasn’t Had Time to Build Up Yet

Even though refunds feel like something that happens in February or March, legally they start accruing on January 1 — with every paycheck.

If you wait until:

March, April, or later,

you may have already “earned” a significant portion of the upcoming refund, which could become part of the case and the trustee could take next year.

Filing earlier in the year often means:

✔️ less of the new refund is at risk

✔️ more flexibility in planning

3. Bank Account Balances Are Often Lower After the Holidays

Right after Christmas:

accounts are usually drained,

credit cards are maxed,

and refunds haven’t arrived yet.

In Florida, where cash in the bank can be an issue beyond limited exemptions, January often means:

✔️ fewer problems with bank balances

✔️ less stress over “what’s in the account” on filing day

4. January Can Help With the Chapter 7 Means Test

The Chapter 7 means test looks at your last six full months of income before filing.

For example:

Filing in January looks at income from July–December.

Filing in February looks at August–January.

For many people:

overtime, bonuses, or seasonal income happened earlier in the year,

while fall and winter income may be lower.

That means filing early can sometimes:

✔️ improve eligibility for Chapter 7

✔️ avoid being pushed into a Chapter 13 unnecessarily

This is a key reason early-year consults matter for clients throughout Fort Myers, Cape Coral, Naples and all of Florida.

Expecting a Big Refund for 2025? Planning Early Is Critical

If you know you typically receive a large refund for the current tax year, waiting until after it hits can limit your options.

When you talk to a bankruptcy lawyer in January or February, it allows time to:

plan around refund timing,

avoid panic spending,

consider adjusting withholding when appropriate, (this is a big deal if you usually use your tax refund as a savings account)

and choose the filing date that protects you best.

The earlier you get advice, the more tools your attorney has to work with to help you save and keep your refund.

Why “Waiting for the Refund to Fix It” Usually Backfires

We hear this every season:

“Once my refund comes, I’ll catch up.”

But in reality:

interest keeps growing,

late fees keep stacking,

emergencies pop up,

and minimum payments barely touch the balance.

A few months later, the refund is gone… and the debt is still there.

Worse, people sometimes use refunds to:

❌ pay one creditor (which can create problems before filing),

❌ drain accounts out of fear,

❌ or delay until lawsuits or garnishments start.

By then, what could have been strategic planning turns into damage control.

Bankruptcy Isn’t About Giving Up... It’s About Creating a Plan

For many families, bankruptcy can:

✔️ stop collection calls and lawsuits

✔️ halt foreclosures and repossessions

✔️ protect income and accounts

✔️ create breathing room

✔️ and offer a real path forward

The goal isn’t to erase responsibility — it’s to stop the constant emergency long enough to build something stable again.

The Big Takeaway: January Is About Options & Fresh Starts!

January isn’t “magic.” But for people expecting large tax refunds, it often offers:

✔️ last year’s refund already spent

✔️ new refund not yet built up

✔️ lower bank balances

✔️ favorable income lookback

✔️ more time to plan

In short: more control.

And when it comes to bankruptcy, timing can be everything.

Talk to a Florida Bankruptcy Attorney Before Your Refund Hits

If you live in Fort Myers, Naples, Cape Coral, Lehigh Acres, Bonita Springs, Estero, or anywhere in Florida and expect a tax refund this year, now is the time to get real answers.

At Lynn Law Group, we help individuals and families understand:

how tax refunds are treated in bankruptcy,

when to file,

and how to protect as much as the law allows and as their individualized situation requires.

Every situation is different — and a short conversation early in the year can make a life-changing difference!

📞 If you are ready for your fresh start, call us today for a free consultation and find out what your options really are.

This article is for informational purposes only and does not constitute legal advice. Reading this does not create an attorney-client relationship.

Last week, members of the Southwest Florida bankruptcy community gathered to watch the 2026 State of the District Address delivered by the Chief Judge of the United States Bankruptcy Court for the Middle District of Florida. Although the address was presented remotely, our local professionals still came together in person. The Southwest Florida Bankruptcy Professionals Association (SWFBPA) hosted a watch party so attorneys, paralegals, trustees, and financial professionals across our region could hear the updates collectively and discuss what they mean for the people we serve here in Southwest Florida. I’m especially honored this year to be serving as the 2026 Vice President of the Southwest Florida Bankruptcy Professionals Association, an organization dedicated to improving communication, collaboration, and education within the bankruptcy system throughout our local district. A Noticeable Shift: Filings Are Increasing Again One of the realities discussed, and something many of us are seeing firsthand, is that bankruptcy filings have been gradually increasing year over year again That trend isn’t surprising. Families across Florida have been navigating: Higher insurance costs Increased interest rates Rising everyday expenses Fluctuating income in industries tied to housing and tourism In areas like Fort Myers, Cape Coral, Naples, and Bonita Springs, and Estero, these shifts are often felt quickly at the household level. When filings begin to rise, it’s usually not because people suddenly became irresponsible. More often, it’s because the financial margin that once existed has disappeared. For professionals working in this space, that trend is an important reminder: access to accurate information and steady guidance matters more than ever. Why Events Like the State of the District Matter The State of the District Address offers insight into: Current filing trends across the Middle District of Florida Operational updates from the court Emerging issues affecting debtors and creditors Practical realities professionals are seeing across the state Staying informed helps those of us who work directly with individuals and small business owners respond thoughtfully rather than reactively . When the system is functioning well...and when professionals are communicating...it becomes easier for people to stabilize their situation instead of spiraling further into crisis. Offering More Than Legal Answers As filings increase, I’m reminded that the most important thing many people need at the beginning isn’t a legal strategy, it’s simply someone willing to listen, without judgment. By the time most individuals reach out to a bankruptcy professional, they’ve often spent months or even years trying to hold everything together on their own. Many carry a significant amount of stress and, unfortunately, a lot of shame. One of the reasons I’m passionate about this area of law is that bankruptcy exists to provide a lawful, structured path forward. It was designed to give people: Protection Time to regroup Breathing room And ultimately, a genuine fresh start Helping clients understand that this process is a tool (not a personal failure!) is just as important as the legal work itself to me. Especially in times when filings are rising, it becomes even more important for professionals to offer not just technical knowledge, but also patience, clarity, and reassurance, they do call us counselors at law, after all! The Role of the Local Bankruptcy Community One of the most meaningful parts of the SWFBPA watch party was seeing so many different professionals in one room. All people who all play a role in helping the system function fairly. Bankruptcy is never handled by a single person. It requires coordination between: Judges Trustees Attorneys Court staff Financial professionals When those groups stay connected, the process tends to work more smoothly for the individuals at the center of it, the families trying to regain stability. SWFBPA’s mission has always been to strengthen that collaboration here in Southwest Florida, and events like this reinforce why that effort matters. Flipping the Script on the Conversation Around Debt Even as filings rise, many people still hesitate to ask questions because of the stigma surrounding bankruptcy. In reality, most financial hardship is tied to life events or economic shifts, not personal character. Normalizing conversations about debt allows people to: Seek help earlier Avoid unnecessary escalation Preserve more of what they’ve worked hard to build For many Florida families, simply having a safe place to ask questions without judgment is the first step toward real financial recovery. Moving Forward with Purpose Serving as Vice President of SWFBPA this year has reinforced something I see every day: when professionals stay informed, collaborative, and focused on practical solutions, the bankruptcy system works the way it was intended. The goal is never to push someone toward filing. The goal is to make sure that if relief is needed, people understand their rights and their options...and can move forward with clarity and dignity instead of fear. As economic pressure and distress continue to affect households across Fort Myers, Naples, Cape Coral, Bonita Springs, and the surrounding Southwest Florida communities, offering clients a listening ear, steady guidance, and reliable knowledge is more important than ever. For many, that combination is what finally makes a fresh start feel possible. About the Author Veronica Batt is a bankruptcy attorney based in Southwest Florida, serving all of Florida, and currently serves as the 2026 Vice President of the Southwest Florida Bankruptcy Professionals Association. Her work focuses on helping individuals and families understand their financial options, reduce fear and shame around the process, and move toward long-term stability with dignity.

Will People Find Out If I Filed Bankruptcy? One of the most common (and most personal) concerns we hear from clients is this: “If I file bankruptcy, is everyone going to find out?” People worry about their employer. Their family. Their community. They worry about judgment, embarrassment, or the idea that filing bankruptcy somehow becomes public knowledge overnight. Here’s the reality, explained clearly and honestly by experienced Florida bankruptcy attorneys: In the vast majority of cases, no one will know you filed bankruptcy unless you choose to tell them. Bankruptcy Is Not Publicly Announced Yes, bankruptcy is filed in federal court. But that does not mean it is advertised, published, or broadcast in any way. There is: No announcement No public posting No newspaper notice No social media alert No mailing to friends, family, or employers When a bankruptcy case is filed, only two parties are automatically notified: The bankruptcy court Your creditors That’s it. Your employer is not notified (unless you had a prior garnishment, in which case your employer will be very happy to not have to deal with that anymore!). Your family is not notified. Your friends, neighbors, or community are not notified. Unless someone is actively searching federal bankruptcy court records (something most people never do and most attorneys wouldn't even know how to do) they would have no reason or ability to know. Will My Employer Find Out If I File Bankruptcy? This is one of the biggest fears we hear from clients throughout Fort Myers, Naples, Cape Coral, and across Florida. In a Chapter 7 bankruptcy, your employer is not contacted at all. In a Chapter 13 bankruptcy, some cases involve a wage deduction order. If that applies, the notice goes directly to payroll or human resources (not your supervisor) and it does not disclose personal financial details. Just as important: ➡️ Federal law strictly prohibits employers from discriminating against you for filing bankruptcy. Your job is protected. Will Friends, Family, or the Public Find Out? There is no letter sent to your family. There is no notice to your friends. There is no public list circulated. While bankruptcy is technically a public record, it is not something people casually stumble upon. Someone would need to intentionally search federal court databases, know exactly what they are doing, and know who to search for. In real life, that simply doesn’t happen. How Common Is Bankruptcy? Here’s a fact that surprises most people: About 1 in 10 Americans will file bankruptcy at some point in their lifetime. That means: Someone you work with has likely filed Someone in your neighborhood has likely filed Someone you interact with regularly has likely filed You just don’t know - because bankruptcy is far more private and common than people realize. Why Fear and Shame Delay Relief As bankruptcy attorneys serving Fort Myers, Naples, Cape Coral, Miami, and throughout Florida, we don’t see people come in too early. We see people come in years too late...after: Lawsuits have been filed Judgments have been entered Bank accounts have been frozen Wages have been garnished Stress has taken over daily life Not because they didn’t have legal options. But because fear and shame kept them silent. That delay often causes more harm than the debt itself. Bankruptcy Is a Legal Right... It Is Not a Moral Failure Bankruptcy exists for a reason. It is a federal legal tool designed to: Stop collection activity Halt lawsuits and garnishments Protect homes, vehicles, and income Give individuals and families a true financial reset Using the law as it was intended is not something to be embarrassed about. It is informed. It is lawful. And for many people, it is life-changing. The Bottom Line If you’re worried that filing bankruptcy means everyone will find out, take a deep breath. For most people: ✔️ It remains private ✔️ It remains professional ✔️ It stays between you, your attorney, the court, and your creditors If debt stress is affecting your peace of mind, getting accurate information early can make all the difference. This article is for informational purposes only and does not constitute legal advice. Reading this article does not create an attorney-client relationship.

For many people, January doesn’t feel like a “fresh start.” It feels like a financial hangover. The holidays are over. Credit card statements start to arrive. Minimum payments go up because of the holiday spending thrown back on to a credit card. Collection calls resume. Lawsuits and garnishments that paused in December often restart in the new year. And quietly, behind the scenes, something else is happening that most people don’t realize: The timing of a bankruptcy filing...especially early in the year... can significantly affect how much money and protection you keep. This January–March period is one of the most important (and most misunderstood) windows when it comes to bankruptcy planning in Florida. Why Timing Matters More Than Most People Think One of the biggest misconceptions about bankruptcy is that it’s only about how much debt you have. In reality, bankruptcy also looks at timing. When you file, the court examines: Income over specific lookback periods (6 Months) Bank balances Tax refunds Recent payments to creditors Transfers or use of funds That means when you file can be just as important as whether you file. Early planning often creates more options, more protection, and far less stress. The Tax Refund Mistake We See Every Year Between January and March, many people receive (or expect) a tax refund. And the most common instinct is understandable: “I’ll just use my refund to pay down some debt.” Unfortunately, this often backfires and just kicks the can down the road. Here’s why: Partial payments rarely solve the underlying problem Credit card balances often rebound within months The refund is gone, but the debt remains In some cases, using a refund incorrectly can create complications later A tax refund can feel like relief ... but without a strategy, it often becomes a temporary pause, not a solution. How Bankruptcy Treats Tax Refunds (In Simple Terms) In bankruptcy, a tax refund can be considered an asset, depending on timing and circumstances. This does not mean: You automatically lose your refund Filing bankruptcy is a bad idea You should rush or panic What it does mean is that planning matters. Early conversations allow a bankruptcy attorney to: Explain how refunds are treated Look at timing options Avoid last-minute mistakes Protect as much as the law allows Waiting until after a refund is spent...or after accounts are drained out of fear... often removes options that could have existed just weeks earlier. The January–March Bankruptcy Planning Advantage Filing (or even just planning) earlier in the year can offer meaningful benefits, including: More flexibility with timing Better protection of refunds and income Fewer rushed decisions Reduced risk of preference or transfer issues Lower stress and clearer expectations Just as importantly, early planning allows people to move from panic to clarity. You don’t have to decide anything immediately. You just need accurate information. Florida-Specific Considerations Matter Bankruptcy is federal law...but Florida exemptions and local court practices matter a great deal. Issues like: Vehicle equity Homestead protection Household property Income timing are all evaluated with Florida-specific rules in mind. That’s why working with an experienced Florida bankruptcy attorney (especially one familiar with local courts) can make a meaningful difference in outcomes. You Don’t Have to Be “Ready to File” to Benefit From a free Consultation One of the most important things we tell clients is this: A consultation is about information, not commitment or obligation- we aren't used cars salesmen. Many people who reach out in January don’t file immediately. Some don’t file at all. But they leave with: A clear understanding of their options A timeline that makes sense A plan instead of fear That alone can change everything. A Fresh Start Doesn’t Begin With Shame... It Begins With Clarity Debt carries a heavy emotional weight. Shame keeps people silent. Fear causes rushed decisions. But bankruptcy, when used thoughtfully, is a legal financial tool... not a moral failure. If you’re feeling overwhelmed early in the year, this January–March window can be an opportunity to pause, assess, and choose a path forward with dignity. Information brings relief. Planning brings control. And clarity opens the door to a real fresh start. Thinking About Your Options? If you’re navigating debt this January, February, or March, speaking with a knowledgeable Florida bankruptcy attorney can help you understand your rights, your timing, and your options (even if you’re not ready to file).

Enero es el mes en que muchas personas finalmente vuelven a mirar su realidad financiera. Nuevo año. Nuevas metas. Nuevas decisiones. Pero para muchas familias en Florida, el inicio del año también viene acompañado de estrés, deudas acumuladas y una sensación de vergüenza que no deberían cargar. Si estás leyendo esto, déjanos decirte algo desde el principio: no eres solo, la bancarrota no es un fracaso y no es una trampa. Es una herramienta legal creada para ayudar a personas reales, trabajadoras y responsables, a recuperar estabilidad y empezar de nuevo. Esta guía está escrita en español, para nuestra comunidad en Fort Myers, Cape Coral, Lehigh Acres, Naples, Bonita Springs, Miami, Tampa y en toda Florida. El Nuevo Año es un Momento Estratégico para Informarte Muchísimas personas creen que deben “aguantar un poco más” antes de hablar con un abogado de bancarrota. La realidad es que enero es uno de los mejores momentos para informarte. ¿Por qué? El año fiscal acaba de comenzar Muchas demandas y embargos aparecen en los primeros meses del año Hay oportunidades para planificar ingresos y reembolsos de impuestos (los tax refunds) Puedes evitar errores costosos antes de que sea demasiado tarde Hablar con un abogado de bancarrota en español no significa que ya tomaste una decisión. Significa que estás tomando control y que te estas informando. La Vergüenza Mantiene a la Gente Atrapada en Deudas Uno de los mayores obstáculos que vemos no es legal. Es emocional. A muchas personas les dijeron: “Paga aunque te ahogues” “La bancarrota es solo para irresponsables” “Eso arruina tu futuro” Nada de eso es cierto. La mayoría de las personas que consideran la bancarrota: Trabajan Han intentado pagar por años Han usado tarjetas para sobrevivir, no para lujos! Están enfrentando intereses que crecen más rápido que sus pagos La vergüenza no paga deudas. La información sí. ¿Qué es la Bancarrota y Cómo Funciona en Florida? La bancarrota es un proceso federal diseñado para: Detener llamadas de cobradores Parar demandas y embargos Eliminar o reorganizar deudas Dar un camino legal hacia un nuevo comienzo En Florida, los dos tipos más comunes son: 1. Bancarrota Capítulo 7 Elimina la mayoría de las deudas no aseguradas Es más rápida (normalmente 3-4 meses entre someter la bancarrota a la corte y obtener el descargo de deudas, el discharge) Ideal para personas que califican según ingresos y gastos (Means Test) 2. Bancarrota Capítulo 13 Plan de pagos supervisado y estructurado por el tribunal para 3-5 años Protege bienes importantes Útil para personas con ingresos constantes o ciertos activos Puedes modificar tu mortgage (ipoteca para salvar tu casa en muchos casos) Ponerte al día con atrasos en la hipoteca y en los pagos del carro. En ciertos casos, si el vehículo cumple con los requisitos legales y debes más de lo que realmente vale, es posible modificar el préstamo del auto, reduciéndolo a su valor actual y bajando la tasa de interés. También puede proteger a co-deudores que no presentan bancarrota en algunos casos, permitirte ponerte al día con cuotas de la asociación de propietarios (HOA o COA), y ofrecer una descarga más amplia para ciertas obligaciones de divorcio relacionadas con la distribución equitativa. Además, puede ayudarte a ponerte al día con la manutención de menores (child support) y a pagar impuestos atrasados dentro del caso, congelando intereses y penalidades para que los pagos sean más manejables.Cada caso es distinto. Por eso es tan importante hablar con un abogado de bancarrota que hable español y entienda tu situación completa y con mucha experiencia en bancarrota. ¿Qué Deudas Se Pueden Eliminar? Muchas personas se sorprenden al saber que la bancarrota puede eliminar: Deudas de tarjetas de crédito Préstamos personales Cuentas médicas Deudas antiguas Demandas por deudas no aseguradas Y algo muy importante: el proceso detiene legalmente la mayoría de las acciones de cobro y demandas en la corte. ¿Voy a Perder Mi Casa o Mi Carro? Esta es una de las preguntas más comunes. En Florida existen protecciones muy fuertes, especialmente para: La vivienda principal Ciertos bienes personales Ingresos necesarios para vivir En muchos casos, las personas no pierden su casa ni su carro. La exención de vehículo en Florida se aumentó a $5,000 en julio de 2024. Esto significa que hasta $5,000 en equidad en tu carro están protegidos por la ley. Si no tienes una vivienda principal (homestead) que planeas reclamar, esa cantidad puede ser mayor. Esta exención aplica por cada persona que presenta la bancarrota. Pero todo depende de los detalles, y por eso la asesoría correcta es clave. Atendemos a Clientes en Toda Florida (En Español) Aunque nuestra oficina está en el suroeste de Florida, ayudamos a personas en: Fort Myers Cape Coral Lehigh Acres Naples Bonita Springs Estero Miami Tampa Y en todo el estado de Florida Muchos casos se manejan de forma remota, y siempre con atención directa y personal en español. Cuando ustedes nos llaman, no hablan con un call center, van a hablar con un abogado- van a hablar con Veronica o Adrian. El Mejor Primer Paso es Informarte El nuevo año no tiene que ser una repetición del anterior. Si las deudas están afectando: Tu sueño Tu salud Tu familia Tu tranquilidad No tienes que cargar eso en silencio. Hablar con un abogado de bancarrota en español en Florida puede darte claridad, opciones y alivio — incluso antes de tomar cualquier decisión. Un Mensaje Final para el Nuevo Año La bancarrota no define quién eres. Las deudas no definen tu valor. Pedir información no es rendirse — es avanzar. Este año puede ser diferente. Y empieza con conocimiento, no con vergüenza.

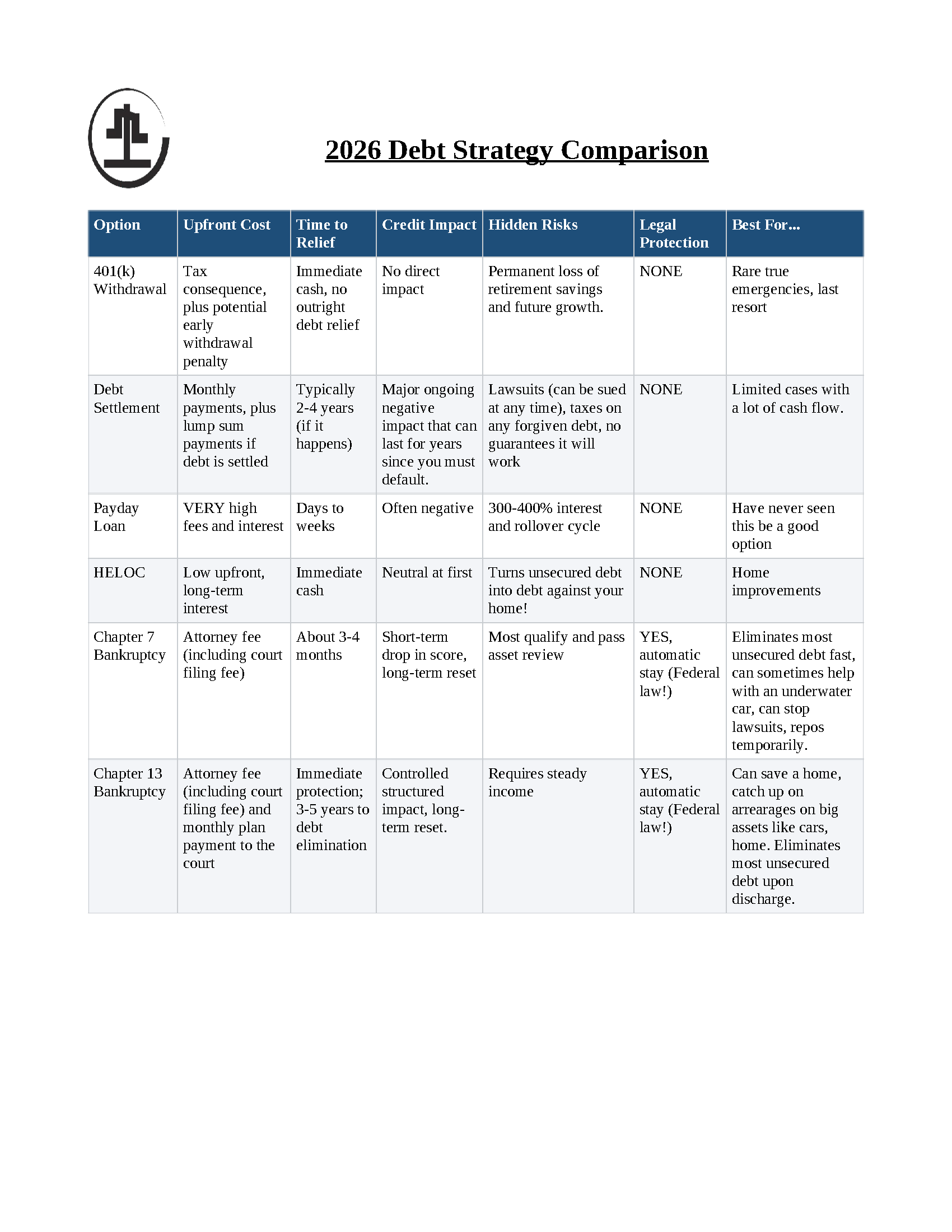

As a new year begins, many people take a hard look at their finances. January is often the moment when reality sets in. Holiday balances are higher, interest keeps compounding, and the question becomes: “What is my actual plan for this debt in 2026?” If you’re evaluating your options right now, you’re not alone. Every year, especially at the start of a new one, people begin comparing debt strategies like debt settlement, 401(k) withdrawals, HELOCs, and bankruptcy to figure out what makes sense moving forward. This guide breaks down those options clearly — without sales pitches, fear tactics, or shame — so you can make an informed decision. Why People Re-Evaluate Debt at the Start of the Year January creates a natural pause point. Credit card statements reflect holiday spending Interest resets feel heavier Tax season & refund season are approaching Financial stress becomes harder to ignore For many households, the new year isn’t about “getting ahead” — it’s about stopping the damage and choosing a strategy that actually works. The problem is that many popular debt solutions *sound* safer than bankruptcy, but quietly carry more risk. Common Debt Strategies (And Their Real-World Tradeoffs) 1. 401(k) Withdrawal Withdrawing from retirement often feels like using money you already own. But in practice, it usually means: Immediate income tax consequences Early withdrawal penalties (if you're under 59½) Permanent loss of protected retirement funds No actual debt relief — just temporary cash For most people, this doesn’t solve the debt problem. It just removes one of the few assets the law strongly protects. An asset that would have been fully protected in bankruptcy too. I always say don't borrow from your future to try to fix your past. 2. Debt Settlement Debt settlement typically requires stopping payments and defaulting on your debt and waiting for creditors to negotiate. During that time: Accounts default Credit damage continues Lawsuits can (and many times are!) still be filed Garnishments can still happen Forgiven debt may be taxable There is no guarantee settlement will succeed We regularly see clients come in after trying debt settlement — often when lawsuits have already started, who have paid thousands of dollars to these companies and still have to file bankruptcy. 3. Payday Loans Payday loans are marketed as short-term relief, but often involve: Extremely high interest rates (sometimes 300–400%) Rollover cycles that trap borrowers Increased financial instability In practice, they almost never improve long-term outcomes. I have never seen these be a good idea. 4. HELOCs Guys, this is the saddest one of them all to me. Using home equity to pay unsecured debt is one of the most dangerous strategies we see. It: Converts credit card debt into debt secured by your home Puts Florida homestead protection at risk Often leaves people worse off if income changes It literally risks the roof over your head, when Florida offers one of the strongest homestead protections in the country! This is especially risky for people already under financial strain. How Bankruptcy Differs From Other Debt Strategies Bankruptcy is governed by federal law, not private contracts or empty promises. That difference MATTERS. Chapter 7 Bankruptcy Eliminates most unsecured debt in about 3–4 months Immediately stops collection activity through the automatic stay Can pause lawsuits, garnishments, and repossessions Often allows faster financial recovery than alternative strategies Credit takes one hit and then the rebuilding can start versus these other methods (especially debt settlement!) where you default, ruin your credit, and still have to figure out a way out in the end. Chapter 13 Bankruptcy Provides immediate legal protection (like Chapter 7!) Creates a structured repayment plan over 3–5 years Can stop foreclosure and repossession Allows people to catch up on arrears Remaining qualifying unsecured debt is typically discharged at the end Why Bankruptcy Often Outperforms Other Options Bankruptcy usually outperforms every option in Florida, especially when you choose an experienced Bankruptcy attorney. When comparing debt strategies, the biggest differences come down to legal protection and predictability. Bankruptcy Debt Settlement Stops lawsuits YES NO Stops garnishments YES NO Federal legal protection YES NO Predictable outcome YES. NO Tax on forgiven debt NO. Often yes This comparison is a hill that I and most Bankruptcy attorneys will "die on." Bankruptcy exists specifically to stop financial freefall, not to punish people who are already struggling. A New Year, A Clearer Plan One of the most common things we hear in January is: “I don’t want to carry this into another year.” That doesn’t mean bankruptcy is right for everyone. But it does mean that continuing without a plan often causes more harm than relief. Bankruptcy is not a failure! It is a legal tool designed to restore stability when the numbers no longer work. Talk to a Florida Bankruptcy Attorney Before Making a 2026 Decision Before pulling from retirement, risking your home, or committing to years of uncertainty and shelling out money, it’s worth understanding all your options under current law. 📍We serve Fort Myers, Naples, Cape Coral, Lehigh Acres & all of Florida Call or text us to schedule your free consultation! ⚖️ Lynn Law Group — Florida Bankruptcy Attorneys with over 37 years of combined experience.

Debt is one of the most common sources of stress for individuals and families in Florida. Yet bankruptcy — one of the most powerful legal protections available — remains widely misunderstood. This guide explains 10 essential truths about debt and bankruptcy, written to help Florida consumers make informed decisions before financial pressure turns into an emergency. 1. Most People Who File Bankruptcy Did Not Mismanage Money Contrary to popular belief, the majority of bankruptcy cases are caused by life events, not reckless spending. Life happens. Common triggers include: Medical bills or illness Job loss or reduced income Divorce or separation Inflation and rising cost of living Small business failure Supporting family members during hardship Bankruptcy law is mentioned in the United States Constitution and exists because Congress recognized that financial collapse often results from circumstances beyond a person’s control. 2. Bankruptcy Is a Federal Legal Right, Not a Loophole Bankruptcy is not a trick or shortcut. It is a constitutionally authorized legal process governed by federal law and overseen by the U.S. Bankruptcy Courts. Its purpose is to: Stop aggressive collection activity Create an orderly resolution of debt Allow individuals and families a lawful financial reset Using bankruptcy protections is no different than using other legal rights available under U.S. law. 3. The Automatic Stay Is One of the Most Powerful Consumer Protections in Law When a bankruptcy case is filed, a legal injunction called the automatic stay immediately goes into effect. In most cases, it stops: Lawsuits Wage garnishments Bank levies Foreclosure actions Repossession attempts Collection calls and letters This protection applies nationwide and is often the fastest way to stabilize a financial situation. Most people think getting rid of debt is the most powerful thing about bankruptcy, but I think the most powerful part is the automatic stay! 4. Bankruptcy Does Not Mean You Lose Everything A common fear is that filing bankruptcy means losing all assets. In reality, most people keep their essential property. Federal and Florida state exemption laws often protect: A primary residence (Florida has one of the strongest homestead protections in the country!) Vehicles up to $5,000 in equity per debtor filing (raised from $1000 to $5000 in July 2024) Retirement accounts (don't withdraw those funds or they might lose their protected status!) Household goods (up to $1000 in personal property) Tools of trade Wages and benefits In most of our Chapter 7 cases, individuals have kept all of their property! 5. There Is More Than One Type of Bankruptcy — and the Choice Matters The two most common consumer bankruptcy chapters are: Chapter 7 Eliminates qualifying unsecured debts Typically completed in 3-4 months Often appropriate for those with limited disposable income BUT you have to qualify based on the Means Test Chapter 13 Creates a court-approved repayment plan Can stop foreclosure and allow arrears to be cured Often used by homeowners or individuals with steady income The “right” chapter depends on income, assets, goals, and timing — not just debt amount. 6. Bankruptcy Can Stop Foreclosure and Repossession — Even at the Last Minute In many cases, filing bankruptcy can: Pause a foreclosure sale Stop a vehicle repossession Halt eviction proceedings (with limitations) Timing is critical. The earlier legal advice is sought, the more options may be available. (We have even stopped foreclosure sales that were scheduled for the next day with the automatic stay!) Don't wait until the last minute, the sooner you reach out, the more options you will have available. 7. Bankruptcy Often Rebuilds Credit Faster Than Doing Nothing (or debt settlement!) While bankruptcy does impact credit initially, many people are surprised to learn that credit recovery often begins sooner than expected. Why: Debt-to-income ratios improve Past-due accounts are resolved Consumers can rebuild without ongoing defaults For some, remaining buried in delinquent debt can be more damaging long-term than filing. Debt settlement involved defaulting on your debt often for numerous months. It cannot guarantee that a debt will actually be settled, and you can still get sued! A clean Chapter 7 can get that same debt wiped out in 3-4 months so the person can start rebuilding right away. We like to say, Bankruptcy stays on your credit for a long time, but AFFECTS your credit for far less. WE have clients get credit card offers within weeks of getting their discharge. We have clients buy a home within 1.5- 2 years! With Bankruptcy you take one hit, and then start rebuilding. With debt settlement, you take numerous hits and may not even get the debt settled anyway and we have had clients pay hundreds of dollars per month to these companies and they have to file bankruptcy anyway. 8. Not All Debts Are Treated the Same in Bankruptcy Some debts are more difficult — or impossible — to discharge, including: Certain taxes Domestic support obligations Most student loans (with limited exceptions) Debts incurred through fraud However, many people are surprised by how much debt is dischargeable, including credit cards, medical bills, personal loans, some judgments, equitable distribution (from divorce), repossession debt, car loans, and so much more. 9. Waiting Too Long Can Reduce Your Options Delaying action can lead to: Asset loss Frozen bank accounts Increased legal fees Limited chapter eligibility Fewer strategic choices Bankruptcy planning is legal — but only when done before a crisis escalates and with advice from an experienced bankruptcy attorney. 10. Bankruptcy Is About Stability, Not Shame Bankruptcy is not about erasing responsibility. It is about restoring stability so individuals and families can move forward without constant financial pressure. For many, it is the moment when: Stress levels decrease Family relationships improve Sleep returns Planning becomes possible again Seeking information early is often the most responsible financial decision a person can make. Final Thought: Information Is Power You do not have to be “ready to file” to learn about bankruptcy. Understanding your rights early can prevent irreversible damage later. If debt is affecting your peace of mind, learning how bankruptcy law works is not failure — it is preparation. Disclaimer This article is for general informational purposes only. It is not legal advice and does not create an attorney-client relationship. Bankruptcy law varies by jurisdiction and individual circumstances. About Our Bankruptcy Practice Lynn Law Group provides bankruptcy and debt-relief guidance to individuals and families throughout Florida. Our attorneys regularly handle Chapter 7 and Chapter 13 bankruptcy matters for clients in Fort Myers, Naples, Cape Coral, Lehigh Acres, Bonita Springs, and surrounding communities, as well as clients across the state of Florida remotely. We are passionate about helping families and individuals overcome difficult debt situations and find relief and a fresh start. We are an husband and wife attorney team, who live and breathe debt relief for our clients daily and we would be honored to help you with yours!

🎄 Year-End Debt Stress? Why the Holidays Are the Most Important Time to Talk to a Bankruptcy Attorney in Fort Myers, Naples, Cape Coral, Lehigh Acres, Bonita Springs, Miami and all of Florida As the holiday season approaches, many families across Fort Myers, Naples, Cape Coral, Lehigh Acres, and Bonita Springs feel the pressure to make the season magical... even when the budget is already stretched thin. Between rising costs, high interest rates, and unexpected expenses, this time of year can magnify financial stress. If you’re feeling overwhelmed by debt before the new year even begins, you are not alone, and you are not out of options. In Southwest Florida, thousands of people turn to Chapter 7 and Chapter 13 bankruptcy every year to regain control of their finances and start fresh. At Lynn Law Group, our family-run law firm focuses on helping Southwest Florida residents understand their rights, evaluate their options, and begin the path toward a stable financial future. 🎁 Why the Holidays Often Trigger Financial Turning Points The period between Thanksgiving and the New Year has a predictable pattern: -Credit card balances spike -Temporary expenses (travel, gifts, food, childcare) pile on -Interest rates climb -Minimum payments become harder to manage -Collection activity increases after the holidays For many people in Fort Myers, Naples, Cape Coral, and Lehigh Acres, this is when they begin searching for a bankruptcy attorney near them. ⭐ Bankruptcy is not a last resort — it’s a legal tool designed to protect you. The U.S. Constitution provides for bankruptcy because life happens: medical bills, job loss, divorce, unexpected emergencies, and inflation. If your finances have taken a hit in 2024 or 2025, the law gives you a way to reset. 🌟 Should You File Bankruptcy Before or After the Holidays? This is one of the most common questions we receive from clients in Fort Myers, Naples, Cape Coral, Lehigh Acres and Bonita Springs. Here’s the simple breakdown: ✔ Filing before the holidays may help if: You are facing lawsuits, garnishments, or bank levies You are behind on high-interest credit cards You need protection from creditors right now You want a clean slate going into the new year You have a foreclosure sale scheduled ✔ Filing after the holidays may help if: You expect holiday expenses but are not yet ready to file You are waiting for a year-end bonus You need time to gather financial documents You want to eliminate holiday credit card debt in a Chapter 7 You are expecting a large tax refund for 2025. Because every case is unique, we evaluate timing carefully for clients in Fort Myers, Naples, Cape Coral, Bonita Springs, and Lehigh Acres. 🕯 What Chapter 7 Bankruptcy Really Does Here is what Chapter 7 Bankruptcy can really do for you: Eliminates most unsecured debt Stops all collection calls Stops lawsuits and garnishments Protects you through the automatic stay Gives you a true financial reset With Florida’s generous exemptions, most clients keep all or most of their property. Think of it as a quick cut, a fresh start that usually takes around 4-ish months for a straightforward case. You do have to qualify for it though, based on the Means Test. If you qualify based on the Florida Means Test, Chapter 7 is often the fastest and simplest path to a fresh start. We always try to get our clients into a Chapter 7, unless there are specific goals and issues at play. 🎄 Holiday Debt Danger Signs If any of these apply, it may be time to talk with a Southwest Florida bankruptcy attorney. Here are some common things that shed light on a deeper issue with debt: -You’re paying one card with another card -You’re skipping bills to pay for essentials -You’re being sued or threatened with garnishment -You’re using payday loans, cash advances, or buy-now-pay-later apps -Your credit score keeps dropping despite making payments -High interest rates make progress impossible -These issues are extremely common for families from Fort Myers to Naples, and from Cape Coral to Lehigh Acres — especially during the holidays. 🎆 Why Many People Choose to Start Fresh on January 1 At Lynn Law Group, we call it the Fresh Start Season. January is one of the most popular months to file bankruptcy because: People want to start the New Year with a clean slate, or at least a path to one. This is also a time when c reditors ramp up collection efforts on old judgments (something we have actually been seeing a ton in our practice right now- 10 year old judgments rearing their ugly head). In addition to increased collection actions: -Tax refund planning begins -Financial stress becomes impossible to ignore -Whether you need immediate protection or want to plan ahead, we help families across Fort Myers, Naples, Cape Coral, Bonita Springs, and all of Southwest Florida understand their options and move confidently into the new year. 💼 Why Southwest Florida Chooses Lynn Law Group We are a boutique, family-run bankruptcy and consumer-protection law firm serving all of Lee and Collier County, including: Fort Myers Naples Cape Coral Lehigh Acres Bonita Springs Estero Pine Island Surrounding communities Clients consistently choose us because: You speak directly with an experienced bankruptcy attorney We offer evening and weekend appointments We are bilingual (English & Spanish) We handle Chapter 7, Chapter 13, Subchapter V, FCCPA violations, FCRA cases, and more We educate and empower clients to take back control of their lives. Our mission is simple: to help you build a financial life you’re proud of, with dignity and without judgment. It is OK to talk about debt. 🎁 Ready to Explore Your Options? If this holiday season brings more stress than joy, it may be time to explore whether bankruptcy or debt relief can give you the fresh start your family deserves. Don't drag debt into the New Year without a concrete plan. We listen without judgment. We proudly serve clients across Fort Myers, Naples, Cape Coral, Lehigh Acres, Estero, Bonita Springs & all of Florida remotely. Schedule a free confidential consultation today- call or text us today at 239-332-3720 Bankruptcy was built for seasons like this. Bankruptcy exists for a simple reason: Good people hit hard times. The holiday season is not just a sentimental moment. It is one of the most strategic moments of the year to take control of your financial future. As a boutique, family-run bankruptcy law firm, Lynn Law Group helps individuals and families across Southwest Florida understand their options during this challenging time. We can help restore financial stability before debt mounts further. 💬 Frequently Asked Questions 1. If I file bankruptcy in December or January, what happens to my holiday purchases? In many cases, holiday spending can be included in a Chapter 7 discharge, but “luxury purchases” or cash advances may require special analysis. We evaluate this carefully to prevent issues. 2. Will I lose my car or home if I file bankruptcy in Florida? Most clients keep their property. Florida has some of the strongest exemptions in the country, and bankruptcy is designed to protect — not punish — families, Florida now allows up to $5,000 in a vehicle per person, which can be increased with the wildcard if someone is not claiming a homestead for instance. Although it has to qualify, Florida's homestead exemption is one of the strongest in the country! This allows most people to keep their home and get bankruptcy and debt relief without losing the roof over their head. 3. How do I know if Chapter 7 or Chapter 13 is right for me? It depends on income, assets, goals, and the Florida Means Test. We help clients across Fort Myers, Naples, Cape Coral, Bonita Springs, Lehigh Acres, and all of Florida remotely, determine the best chapter. We conduct a detailed analysis with our clients at our first free consult. 4. Can bankruptcy stop a lawsuit or garnishment? Yes. The automatic stay immediately stops most creditor actions, including garnishments, bank freezes, and lawsuits. 5. Is bankruptcy confidential? Bankruptcy filings are public records, but very few people will ever search them. Most clients’ employers, neighbors, and friends never know. 🎁 Ready for a Fresh Start? If debt has made this holiday season more stressful than joyful, you don’t have to wait another year to take control. At Lynn Law Group, we proudly help families in: Fort Myers Naples Cape Coral Bonita Springs Lehigh Acres Estero All surrounding Florida communities Gain peace of mind, clarity, and a path forward. Your fresh start can begin today — or right after the holidays. We’re here when you’re ready.

What This Means for Our Clients and Community At Lynn Law Group, we are proud to share an extraordinary milestone for our firm and for the Southwest Florida community we serve. In November 2025, Attorney Adrian Lynn - founder of Lynn Law Group and a bankruptcy attorney with more than 25 years of experience—was formally sworn in as a member of the Bar of the Supreme Court of the United States. This honor is reserved for attorneys who demonstrate high ethical standards, professional achievement, and dedication to the practice of federal law. For our clients, individuals, families, and small business owners navigating financial distress, this accomplishment represents far more than a ceremonial credential. It is a meaningful reflection of our firm’s commitment to excellence, federal expertise, and unwavering advocacy on behalf of those seeking a financial fresh start. Below is what this milestone means for our clients and for the future of bankruptcy representation in Southwest Florida and beyond. A New Milestone in a Career Dedicated to Helping Families in Crisis Attorney Adrian Lynn has spent more than two decades serving clients through bankruptcy, debt litigation, mortgage issues, foreclosure defense, and creditor harassment claims. Having filed and overseen thousands of bankruptcy cases across Florida, he brings both technical expertise and human-centered advocacy to every matter. Being sworn in to the U.S. Supreme Court Bar is a testament to that career-long dedication. Few attorneys nationwide pursue admission to the Supreme Court Bar; fewer still practice almost exclusively in areas shaped directly by federal law. Bankruptcy is one of those areas. While most cases are resolved in federal bankruptcy courts and bankruptcy appellate panels, membership in the Supreme Court Bar reflects a readiness to advocate for clients at the highest possible level. It signals deep respect for the rule of law, meticulous understanding of federal procedure, and a long-term commitment to protecting consumer rights. Bankruptcy Is Federal — And We Are Prepared to Take Cases as Far as Needed Many people are surprised to learn that bankruptcy is governed by federal law. Unlike family law, probate, personal injury, or landlord-tenant matters, bankruptcy is not a state-based legal system. It operates under the United States Bankruptcy Code—legislation passed by Congress and interpreted by federal courts nationwide. Because bankruptcy is federal: The law is uniform across the country. There are some state differences such as exemptions and local rules too of course. Districts and circuits may interpret issues differently, sometimes creating nationwide legal questions. Major consumer bankruptcy questions often reach the U.S. Supreme Court, shaping the rights of debtors and creditors everywhere. Attorney Adrian Lynn’s admission to the Supreme Court Bar underscores our firm’s ability to engage with cases at every level of the federal judiciary. While most consumer cases never require Supreme Court involvement, our clients deserve to know that their attorneys are equipped both legally and professionally to protect their rights all the way up the chain. Why Supreme Court Admission Matters in a Bankruptcy Practice The Supreme Court regularly hears and decides cases that affect consumer bankruptcy, including: How exemptions are applied The dischargeability of certain debts The reach of the automatic stay Creditor misconduct and remedies Chapter 13 plan structures Calculation of income, expenses, and good faith Statutes of limitations and federal preemption Issues involving student loans, mortgages, and lien stripping These decisions directly shape the outcomes available to everyday people seeking relief through Chapter 7 or Chapter 13. When the Supreme Court rules, the entire country follows. For a firm like ours, focused on representing real families, single parents, seniors, small business owners, active-duty military, immigrants, and hardworking people facing overwhelming pressures, staying on top of these decisions is not optional. It is essential. Attorney Adrian Lynn’s admission to the Supreme Court Bar reflects not just an honorific admission, but our ongoing responsibility to remain at the forefront of developments that impact our clients’ futures. Our Firm’s Mission: Protecting Individuals and Families Through Federal Bankruptcy and Consumer Laws. At Lynn Law Group, we do more than file bankruptcy cases. We protect people. We give them space to breathe again. We stop wage garnishments, lawsuits, bank levies, repossessions, and creditor harassment. We restore financial stability and dignity to families who have spent far too long carrying stress alone. Our practice includes: Chapter 7 bankruptcy (fresh start liquidation) Chapter 13 bankruptcy (structured repayment plans) Small business and Subchapter V representation Automatic stay litigation, when creditors do not abide by Bankruptcy law FDCPA and FCCPA creditor harassment claims FCRA credit reporting cases Mortgage-related issues and loan modification disputes Our clients come to us during some of the most difficult seasons of their lives. They deserve attorneys who are not only compassionate, but fiercely capable lawyers who understand federal law, anticipate legal changes, and remain ready to advocate at every level of court if necessary. A Firm Committed to Excellence, from the local Federal Courthouse to the Supreme Court . Attorney Adrian Lynn’s Supreme Court swearing-in is not the end of a journey. It is the continuation of a lifelong commitment to mastery in bankruptcy law. This accomplishment also reflects the shared dedication of our husband-and-wife legal team. Both Adrian Lynn and Attorney Veronica Batt (also sworn into the Supreme Court Bar) continue to invest in advanced training, national conferences, and the highest standards of federal practice. Our firm works every day to bring that level of excellence back home to the people of Fort Myers, Naples, Cape Coral, Lehigh Acres, and across the entire state of Florida. Bankruptcy is not about shame, mistakes, or failure. It is a legal and constitutional right—a federal protection designed to give people a genuine second chance. Having attorneys who understand this deeply, and who are admitted to advocate before the highest court in the country, is a resource we are proud to offer our community. A Final Word to Our Clients and Community If you or someone you love is dealing with debt, collection pressure, lawsuits, or financial instability, you deserve attorneys who take your rights seriously. You deserve lawyers who understand federal bankruptcy law at its highest level and are prepared to protect you every step of the way. Adrian Lynn’s admission to the U.S. Supreme Court Bar is an honor for our firm—but more importantly, it strengthens our mission: to protect individuals and families, restore financial dignity, and deliver the fresh start the law promises. If you are ready for a confidential consultation, we are here for you. Lynn Law Group — Federal Bankruptcy & Consumer Protection Attorneys Proudly serving Southwest Florida and clients statewide

f you’ve been considering bankruptcy in Florida, there’s an important update that could impact your eligibility — and potentially open the door to a fresh financial start! As of November 1, 2025, the U.S. Trustee Program has increased the median income levels for the Florida bankruptcy means test. These numbers determine whether you qualify for a Chapter 7 bankruptcy (which eliminates unsecured debt like credit cards and medical bills) or whether you must file a Chapter 13 repayment plan. Of course there are other considerations that go into which Chapter you should file. But you have to qualify for a Chapter 7. At Lynn Law Group, we’ve helped thousands of families across Fort Myers, Naples, Cape Coral, Lehigh Acres and Florida with the means test— and one thing is certain: the means test isn’t black and white. Even if you’re “over the limit,” there are often ways to qualify once allowable expenses are factored in. 💡 What Is the Means Test, and Why Does It Matter? The bankruptcy means test was created to ensure that those seeking Chapter 7 relief genuinely need it. It compares your household’s current monthly income to the Florida median income for a household of your size. If your income is below the median, you qualify for Chapter 7. If your income is above the median, don’t panic — it just means we need to move to the second part of the test. That second step examines your actual expenses — the cost of living, debts, and obligations that eat away at your disposable income. This deeper analysis often reveals that, even though you’re technically “over,” you still meet the criteria for Chapter 7 once your legitimate living costs are applied. 📊 New Florida Means Test Figures (Effective November 1, 2025) Here are the updated income thresholds for Florida households: Household Size Median Income 1 $68,085 2 $84,305 3 $95,039 4 $111,819 5 $122,919 6 $134,019 (Add $12,100 for each additional household member.) These numbers increase periodically to reflect cost-of-living changes, meaning more Floridians may now qualify for Chapter 7 bankruptcy than before. ⚖️ It’s Not Always Black and White Many people assume that if their income is above the median, Chapter 7 bankruptcy is off the table. That’s simply not true. We routinely meet clients who were told by a friend, or even another attorney, that they “make too much” to file. But the means test allows a detailed look at necessary and reasonable living expenses that can significantly change the outcome. These include, but are not limited to: Mortgage or rent payments Vehicle loans and insurance Taxes and mandatory payroll deductions Health insurance premiums Medical expenses not covered by insurance Childcare and dependent care costs Educational expenses for dependent children Charitable contributions (within limits) Non filing spouse expenses Once we calculate all allowable deductions under federal and local standards, we often find clients who appeared “over the limit” actually qualify for Chapter 7 after all. For example, a family of four with an income of $120,000 may seem too high for Chapter 7 based on the raw numbers. But after accounting for a mortgage, two car payments, medical insurance, and childcare, their disposable income might fall under the threshold, opening the door to Chapter 7. 🧮 How the Means Test Works in Real Life Think of the means test like a financial X-ray. It doesn’t just look at your gross income; it looks at what you realistically have left to pay creditors after life’s necessities. If your disposable income is too high, the court may steer you toward Chapter 13. But if your budget shows little or no leftover income, Chapter 7 is appropriate. The key lies in accurate documentation. We work with clients to gather paystubs, tax returns, receipts, and expense proof to make sure every allowable cost is captured. Small differences such as properly classifying vehicle expenses or including out-of-pocket medical costs — can shift the balance dramatically. 🏡 Why These Changes Matter for Florida Families The November 2025 updates reflect the reality of living costs across Florida. Things like inflation, rising insurance rates, housing prices, and everyday expenses. The increase means that more individuals and families now fall below the median line, making them eligible for a faster, simpler Chapter 7 discharge. Even if you’re still above the limit, these higher figures give your case more room to breathe. Combined with the right strategy and legal insight, they can make the difference between a repayment plan and a full fresh start. 💬 Common Questions About the Means Test Q: Does the means test look at my income today or over time? It looks at your average income over the past six months. If you recently lost a job or your income has changed, we can time your filing strategically so it reflects your current reality. Q: What if I’m self-employed or own a business? We use your gross receipts minus legitimate business expenses, not just the money that lands in your pocket. Q: What if I don’t pass the means test? You may still qualify for Chapter 13, which can stop foreclosures, reorganize debt, and protect your assets. We’ll help you choose the best path based on your goals. ✨ The Bottom Line: Don’t Assume You Don’t Qualify The means test can look intimidating, but it’s only one piece of the puzzle. With experienced guidance, many “over the limit” clients end up qualifying for Chapter 7 once all their expenses are properly documented. At Lynn Law Group, we help clients throughout Fort Myers, Naples, Cape Coral, and across all of Florida understand their options and use the law to their advantage. If you’ve been told you make too much or aren’t sure where you stand under the new November 2025 means test limits, let’s take a second look. You might be closer to a true fresh start than you think! 📞 Contact us today for a free consultation and let’s see if the new Florida means test updates work in your favor.

Why Choosing an Experienced Bankruptcy Attorney Matters More Than You Think Filing for bankruptcy can be one of the most important financial decisions you ever make. It’s not just about filling out forms or checking boxes, it’s literally about protecting your home, your car, and your future. That’s why choosing an experienced bankruptcy attorney can make the difference between a true financial fresh start and years of unnecessary stress or mistakes that could have been avoided. At Lynn Law Group, serving clients throughout Fort Myers, Naples, Cape Coral, Lehigh Acres, and all of Florida, we’ve seen what happens when people try to navigate bankruptcy alone, or with someone who doesn’t fully understand the process. The truth is simple: when it comes to bankruptcy, experience matters. 1. Bankruptcy law is technical and mistakes are costly! Bankruptcy is governed by complex federal laws, local rules, and constantly changing case law. In Florida’s Middle District Bankruptcy Court, even a small mistake like missing a deadline, misreporting an asset, or undervaluing property — can lead to delays, dismissal, or even loss of important protections or assets. For example, one of the most misunderstood areas involves Florida’s exemptions, which determine what property you can keep. The difference between claiming a homestead exemption versus using the wildcard exemption can completely change the outcome of your case. An experienced bankruptcy attorney knows how to use these exemptions strategically to maximize your protection under Chapter 7 or Chapter 13. An experienced bankruptcy attorney can help you strategically plan around potential issues in your case. Filing on your own, or hiring a lawyer who only dabbles in bankruptcy, is like trying to perform surgery with a YouTube tutorial. The stakes are simply too high. As filings increase around the country and specifically in Florida, more and more attorneys will "get into" Bankruptcy. A lot of situations are not clear cut. 2. Statistics prove that having an attorney increases your chances of success According to the American Bankruptcy Institute, in a 2007 study of over 85,000 cases, 17.6% of pro se (self-filed) debtors had their case dismissed compare to just 1.9% of represented debtors. Meaning 8 times the chances of dismissal by filing their own case. With Chapter 13, the number is even more high! In Chapter 13, represented debtors are far more likely to receive their discharge without delay or dismissal. Experienced attorneys know how to respond to trustee questions, negotiate reaffirmation agreements, and prevent issues that commonly derail cases. According to the same data, only about 4% of pro se debtors even had an open case by year 4 of their Chapter 13 case (out of a 5 year plan). In short: representation isn’t just helpful — it’s statistically proven to improve your odds dramatically of getting the debt relief you deserve. 3. A good bankruptcy attorney does more than file your paperwork At Lynn Law Group, we don’t just help you “file bankruptcy.” We help you rebuild your financial life. An experienced attorney will: Analyze your income, assets, and debts to determine whether Chapter 7 or Chapter 13 is right for you. Explain what you can keep under Florida’s exemption laws. Stop creditor harassment, lawsuits, and garnishments immediately through the automatic stay. Protect co-debtors and family members where possible. Guide you through credit rebuilding so you can qualify for a mortgage or car loan sooner than you think. Bankruptcy isn’t the end, it’s the beginning of your financial reset. The right attorney sees the big picture and helps you move forward confidently. 4. Local experience matters in Florida bankruptcy courts Bankruptcy is federal law, but it’s applied locally. That means the rules, judges, and trustees vary from one district to another. Florida has 3 federal districts: Northern, Middle and Southern. Having a Fort Myers bankruptcy attorney who regularly practices in the Middle District of Florida for instance — and knows the preferences of local trustees and judges — can save you time, money, and headaches. At Lynn Law Group, our attorneys have handled thousands of cases across Lee, Collier, Charlotte, Hendry, and Glades Counties. We know what each trustee looks for in a 341 meeting, how to handle reaffirmation agreements efficiently, and how to protect your assets under Florida law, and how local trustees view things and judges are likely to rule on certain issues. That level of local knowledge can’t be learned overnight, it comes from decades of hands-on experience representing real people right here in Southwest Florida. 5. Bankruptcy can open doors, not close them Many people fear that filing bankruptcy means they’ll never recover financially. But in truth, the opposite is often true. Once your debts are discharged, your debt-to-income ratio improves immediately, and you can begin rebuilding your credit responsibly. In fact, many of our clients receive credit card offers or car loan approvals within months of their discharge. And most mortgage lenders allow qualified borrowers to apply for a new home loan two to three years after Chapter 7, or even sooner in Chapter 13 cases. An experienced attorney knows how to guide you through that recovery process: helping you set goals, rebuild credit, and use bankruptcy as the foundation for long-term financial success. 6. Every case is unique and your lawyer should treat it that way There’s no one-size-fits-all bankruptcy. A single mother behind on rent, a business owner trying to save equipment, and a retired couple facing medical bills all have different goals and strategies. An experienced attorney will customize your approach, whether that means filing a Chapter 7 liquidation to wipe out credit card and medical debt, or a Chapter 13 repayment plan to stop foreclosure and catch up on car payments or cram your car loan down. At Lynn Law Group, we take the time to understand your story, your family, and your goals. We don’t just handle paperwork; we create a true roadmap to your fresh start. 7. The value of peace of mind There’s something powerful about knowing your case is being handled correctly from start to finish. When you hire an experienced bankruptcy attorney, you can stop worrying about court dates, deadlines, or creditor letters. You can focus on your life: your family, your job, your recovery — while we handle the legal details. You can’t put a price on that kind of peace of mind. But you can experience it by working with a team that’s been trusted by thousands of Florida families for over 25 years. 8. Get your fresh start — the right way If you’re considering Chapter 7 or Chapter 13 bankruptcy in Fort Myers, Naples, Cape Coral, Lehigh Acres or anywhere in Southwest Florida, don’t go it alone. Choose an attorney who’s experienced, compassionate, and ready to fight for your financial future. At Lynn Law Group, we offer free consultations so you can learn your options before making any decisions. We’ll explain every step clearly, like regular humans no jargon, no judgment, just honest guidance. We re real people too: we are parents, we are locals, and we know how hard the economy is getting in our area. Whether you’re facing wage garnishment, foreclosure, creditor harassment, or overwhelming medical or credit-card debt, we’re here to help you start fresh. Contact Lynn Law Group today to speak with an experienced bankruptcy attorney in Fort Myers, Naples, Cape Coral, Lehigh Acres, or anywhere in Florida. We handle Chapter 7 and Chapter 13 cases across the Middle District of Florida and all over Florida are proud to help good people get the financial relief they deserve. 📞 Call or Text us today to schedule your free consultation online — and take the first step toward your fresh start.